By Troy D. Sides

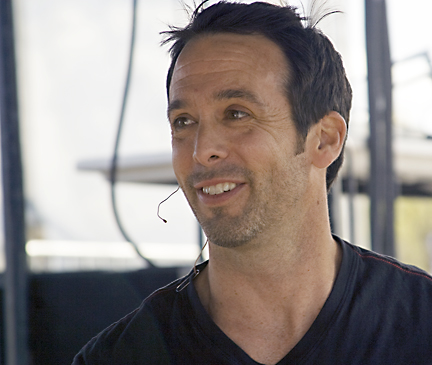

Vince Shorb, co-founder of the event Money XLive, hangs out backstage during Money XLive in Grand Junction on Saturday.

At age 21, Vince Shorb wasn’t too different from any other typical college student. He was taking classes at California State-Fullerton, had a steady girlfriend, and indulged in Taco John’s Taco Tuesday event every week. He owned a few stocks, was involved in starting a business here and there, and overall was just your everyday college student.

Except that he owned real estate in Phoenix, couldn’t afford to put gas in his car, and had a girlfriend (who was without medical insurance) sick with mental illness. He indulged in Taco Tuesdays every week because he was living off of the free tacos they offered, as well as cheap, store-bought canned tuna fish.

“I ate so much canned tuna one time that I got mercury poisoning,” Shorb said in a recent interview. “And the waitress at Taco John’s caught on to me eventually and wasn’t too happy with me. But I got my free tacos.”

Because his girlfriend’s parents wouldn’t take her in amidst all her illnesses, Shorb took her in to take care of her. He paid her medical bills for a while before he finally hit rock bottom.

“I couldn’t even afford to pay for gas,” he said. “I would go to school for a semester or so and then drop out to try to build up another business, thinking it would be this millionaire business. When that didn’t happen I’d go back to school for maybe a semester, but eventually I’d be back trying to build a business. It was just a vicious cycle.”

By age 26, after a couple years of studying how to use money and “desiring it” enough to pull himself out, Shorb found himself out of his financial hole and in the real estate business.

“It was a desperate time,” Shorb said of his financial crisis. “You don’t sleep at night, you’re stressed, you’re pissed, you miss out on a lot of times with your friends, and you’re always having to hustle to make that dollar to pay for rent or food.”

It was in the middle of his career in real estate that things really started to change in his heart as well as his wallet.

“I talked to thousands of people,” he said, “and I would hear all these stories of people being evicted from their homes or having to go move in with their parents. I would try helping these people, building them budgets, but within a few months they’d be back, in trouble again, and asking for money. That’s what sparked my interest in trying to catch these people before they got in trouble.”

Shorb started a company called National Youth Financial Educator’s Council three years ago to help young adults understand money basics across the world. That business grew. From there, Shorb, along with help from his friend Chad Penry, started an event called Money XLive.

“I was focused on building the money,” he said, “but I didn’t have any money management skills. That’s what I try to teach people through Money XLive.”

Combining Shorb’s financial literacy with the celebrities brought in by his friend Penry, Money XLive travels the country teaching money basics to students and other young people all over the country. Shorb says the college students are the people he most wants to reach.

“I always thought that college was great to learn skills that helped you get paid,” he said, “but in school they never taught you about money. They teach you how to make money, but they don’t teach you how to save it.”

Shorb said the main mistake people make with money, and the main reason they get into trouble, is that they don’t save.

“They live beyond their means,” he said. “Most people that are broke now are broke because they don’t manage their money properly; that means not saving.”

Shorb’s message of managing money to avoid the trouble he himself experienced are what drive him to perform Money XLive events all over the country throughout the year.

“It just pumps me up,” he said. “I know if I can just touch one person’s life, if I could just save them one little credit mistake, that’s a year’s worth of work, a year that they can spend with their family or go on vacation; that’s a year of their life. And I love the opportunity to give that to someone.”

For more information on the event as well as how to manage money properly, you can visit the website at www.MoneyXLive.com.

Recent Comments